| Northbound trading(SSE) | Northbound trading(SZSE) | Southbound trading |

| Participant | ||

|

|

Mainland institutional investors and individual investors who hold an aggregate balance of more than RMB 500,000 in their securities and cash account |

| Eligible stocks | ||

|

|

SEHK Securities(Shanghai):

SEHK Securities(Shenzhen):

|

| Excluding stocks | ||

|

|

|

| Quota | ||

| No aggregate Quota Daily Quota: RMB 52 billion |

No aggregate Quota Daily Quota: RMB 52 billion |

No Aggregate Quota Daily Quota: RMB 42 billion for each of Shanghai Connect and Shenzhen Connect, RMB 84 billion in total |

| No. of eligible stocks | ||

| Approximately 570 Stocks | Approximately 880 Stocks | SEHK Securities(Shanghai): Approximately 318 Stocks SEHK Securities(Shenzhen): Approximately 417 Stocks |

| Trading hours | ||

|

Opening Call Auction: 09:15-09:25 Continuous Auction: 09:30-11:30/ 13:00-14:57 Closing Call Auction: 14:57-15:00 Allow order input 5 minutes prior to opening of each trading session(except Closing Call Auction) |

Opening Call Auction: 09:15-09:25 Continuous Auction: 09:30-11:30/ 13:00-14:57 Closing Call Auction: 14:57-15:00 Allow order input 5 minutes prior to opening of each trading session(except Closing Call Auction) |

Pre-opening period: 09:00-09:30 Continuous trading period: 09:30-12:00 13:00-16:00 Closing Auction Session: 16:00-16:10 (16:08-16:10 random closing) |

| Trading and settlement Currency | ||

| RMB | RMB | Trade with HKD Settle in RMB |

| Order Types | ||

| Limit orders only | Limit orders only | Pre-opening: At-auction limit order only |

| Day trading | ||

| Not allowed | Not allowed | Allowed |

| Block Trade | ||

| Not allowed | Not allowed | Not allowed |

| Margin financing | ||

| Allowed | Allowed | Allowed(For certain A shares that SSE/SZSE has determined as eligible for margin trading) |

| IPO participating | ||

| Not allowed | Not allowed | Not allowed |

| Lot size | ||

| 100 shares | 100 shares | Depends on individual share |

| Maximum order size | ||

| 1 million shares | 1 million shares (For stocks listed on SZSE CHINEXT Market, the limit is 300 thousand shares) |

Depends on individual share |

| Tick size | ||

| RMB 0.01 | RMB 0.01 (For stocks listed on SZSE CHINEXT Market, during continuous auction, a 2% up/down range is set in terms of limit order.) |

Depends on individual share |

| Price limit | ||

|

±10% of previous closing price ±5% of previous closing price for stocks under special treatment During Continuous Auction , buy order at a price below its current best bid price by 3% will be rejected (The percentage is data as at 17th September 2014, may be adjusted from time to time subject to market conditions) |

±10% of previous closing price ±5% of previous closing price for stocks under special treatment From Continuous Auction to Closing Call Auction , buy order at a price below its current best bid price by 3% will be rejected (The percentage is data as at 28th September 2016, may be adjusted from time to time subject to market conditions) (For stocks listed on SZSE CHINEXT Market, no price limit is set in the first 5 trading days after the listing. After this period, the daily price limit is set to ± 20% of previous closing price) |

No price limit |

| Settlement cycle | ||

| T+1 | T+1 | T+2 |

| Voting | ||

| Vote via CCASS’s existing voting functions | Vote via CCASS’s existing voting functions | ChinaClear is responsible for submit the votes |

| Manual Trades | ||

| No | No | No allowed |

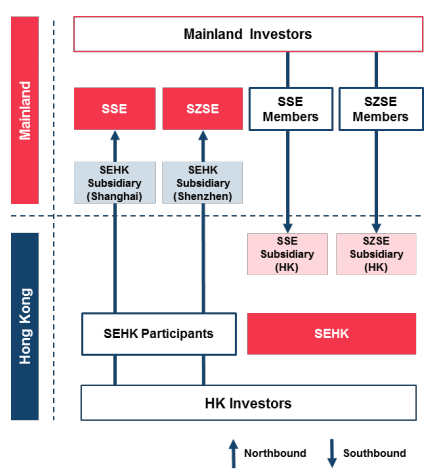

2.1. What is Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect?

Shanghai-Hong Kong Stock Connect is a programme that links the stock markets in Shanghai and Hong Kong. The Shanghai Stock Exchange (“SSE”) and Stock Exchange of Hong Kong Limited (“SEHK”), by establishing technical connections, allow investors from the mainland and Hong Kong to trade in a specified scope stocks listed on the other through local securities companies or brokers. The Shanghai-Hong Kong Stock Interconnection consists of a northbound trading link (“NTL”) and a southbound trading link (“STL”).

Under the NTL, investors from Hong Kong may, through their Hong Kong brokers and a securities trading service company established by SEHK, place orders to the SSE to trade in a specified scope stocks listed on the SSE.

Under the STL, investors from the mainland may, through securities companies in the mainland and a securities trading service company established by the SSE, place orders to SEHK to trade in a specified scope stocks listed on SEHK.

Shenzhen-Hong Kong Stock Connect is a programme that links the stock markets in Shenzhen and Hong Kong. The Shenzhen Stock Exchange (“SZSE”) and Stock Exchange of Hong Kong Limited (“SEHK”), by establishing technical connections, allow investors from the mainland and Hong Kong to trade in a specified scope stocks listed on the other through local securities companies or brokers. The Shanghai-Hong Kong Stock Interconnection consists of a northbound trading link (“NTL”) and a southbound trading link (“STL”).

Under the NTL, investors from Hong Kong may, through their Hong Kong brokers and a securities trading service company established by SEHK, place orders to the SZSE to trade in a specified scope stocks listed on the SZSE.

Under the STL, investors from the mainland may, through securities companies in the mainland and a securities trading service company established by the SZSE, place orders to SEHK to trade in a specified scope stocks listed on SEHK.

Illustration of Order Flow

2.2. If the SSE-listed / SZSE-listed security is removed from the Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect, can we trade the security?

Investors will only be allowed to sell that SSE-listed / SZSE-listed securities but restricted from further buying.

In addition, Investors will only be allowed to sell but restricted from buying such SSE Securities if:

(a) such securities subsequently cease to be a constituent stock of the relevant indices; and/or

(b) they are subsequently placed under risk alert; and/or

(c) the corresponding H shares of such securities are subsequently delisted from SEHK.

Investors will only be allowed to sell but restricted from buying such SZSE Securities if:

(a) such securities subsequently cease to be a constituent stock of the relevant indices; and/or

(b) such securities are, based on any subsequent periodic review, determined to have a market capitalisation of less than RMB 6 billion; and/or

(c) they are subsequently placed under risk alert; and/or

(d) the corresponding H shares of such securities are subsequently delisted from SEHK.

Investors will only be allowed to sell an SEHK Security but restricted from further buying if:

(a) the SEHK Security subsequently ceases to be a constituent stock of the relevant indices; and/or

(b) the corresponding A share of the SEHK Security ceases to be traded on SSE/SZSE or is put under risk alert; and/or

(c) the constituent stock of HSSI without corresponding A share listed on SSE/SZSE subsequently with market capitalisation less than HKD 5 billion based on any subsequent periodic adjustment of relevant index(applicable to southbound trading under SZ-HK Stock Sonnect only); and/or

(d) where the SEHK Security is an H share and the A shares of the issuer becomes subsequently listed on an exchange in the Mainland instead of SSE/SZSE.

2.3. How does the Daily Quota work?

Trading under Shanghai and Shenzhen Connect will be subject to a Daily Quota. There is no Aggregate Quota for Shanghai and Shenzhen Connect as the Aggregate Quota for Shanghai Connect was abolished since 16 August 2016 and none will be introduced for Shenzhen Connect.

| Quota | Northbound(NB) | Southbound(SB) |

| Daily Quota(RMB) | 52 billion(RMB) | 42 billion(RMB) per Shanghai SB / Shenzhen SB Connect |

Daily Quota Balance = Daily Quota-Buy Orders + Sell Trades + Adjustments*

The Daily Quota will be reset every day. Unused Daily Quota will NOT be carried over to next day’s Daily Quota.

SEHK monitors the usage of Northbound Daily Quota on a real time basis. The Northbound Daily Quota Balance is updated each time when a Northbound order is received and executed.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. However, as order cancellation is common during opening call auction, the Northbound Daily Quota Balance may resume to a positive level before the end of the opening call auction. When that happens, SEHK will again accept Northbound buy orders.

Once the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during a continuous auction session, no further buy orders will be accepted for the remainder of the day. The same arrangement will be applied to the closing call auction of SZSE.

It should be noted that buy orders already accepted will not be affected by the Daily Quota being used up and will remain on the order book of SSE and SZSE respectively unless otherwise cancelled by relevant SEHK Participants.

Southbound Daily Quota is monitored by SEHK

* Daily Quota Balance will be increased when a) a buy order is cancelled; b) a buy order is rejected by the other exchange; or c) a buy order is executed at a better price.2.4. How will the cross-boundary regulatory enforcement issues arising from the program be dealt with?

According to the Joint Announcement, both the CSRC and the SFC will actively enhance cross-boundary regulatory and enforcement cooperation. Each of them will take measures to establish an effective regime under the Shanghai-Hong Kong Stock Connect to respond to all misconduct in either or both markets on a timely basis, The CSRC and the SFC will improve the current bilateral agreement to strengthen enforcement cooperation in respect of the following areas:

* Referral and information exchange mechanisms concerning improper activities;

* Investigatory cooperation in relation to cross boundary illegal activities including disclosure of false or misleading information, insider dealing and market manipulation;

* Bilateral enforcement exchange and training; and

* Enhancement of general standards of cross-boundary enforcement cooperation.

The Joint Announcement further notes that the two Commissions will establish a dedicated liaison mechanism for Shanghai-Hong Kong Stock Connect to deal with any issues that may encountered during the pilot program which may require joint resolution.

It is expected that the scope of the existing co-operation arrangement between the SFC and the CSRC will be extended to include Shenzhen Connect upon the launch of Shenzhen Connect.

2.5. Are we protected by the investor compensation fund?

Hong Kong investors participating in the Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect through SEHK Participants will continue to be protected by Hong Kong laws.

Similar to any overseas investment which involves a sub-custody arrangement, investors will also be facing the counterparty risks of ChinaClear.

Similarly for the trading and settlement activities, Hong Kong investors will continue to deal with SEHK Participants and be protected by the SFO.

It should however be noted that the current Investor Compensation Fund will not cover any Northbound activities.

3.1. Are there any disclosure obligations for trading SSE-listed / SZSE-listed Shares?

Under the current PRC rules, when an investor holds or controls up to 5% of the issued shares of an SSE-listed issuer, the investor is required to disclose his interest within three working days. Such invertor may not buy or sell the shares in the listed issuer within the three-day period. For such investor, every time when there is an increase or decrease in his shareholding by 5% or the shares held by him falling below 5% of the issued shares in the listed issuer, the investor is required to disclose the information within three working days.

3.2. What is the pre-trade checking requirement?

Mainland investors are only allowed to sell A shares which are available in their stock accounts at the end of the previous day

When placing sell orders, investors must ensure they have sufficient shares in their accounts on T-1 in order to sell their shares on T day.

3.3. What is the holiday arrangement?

Northbound trading follows SSE’s and SZSE’s trading hours. However, SEHK will accept Northbound orders from SEHK Participants five minutes before the Mainland market sessions open in the morning and in the afternoon.

| Trading Period | Shanghai market | Shenzhen market | Time for SEHK Participants to input Northbound orders |

| Opening Call Auction | 09:15-09:25 | 09:10-11:30 | |

| Continuous Auction (Morning) | 09:30-11:30 | ||

| Continuous Auction (Afternoon) | 13:00-14:57 | 12:55-15:00 | |

| Closing Call Auction | 14:57-15:00 | ||

| After-hours fixed-price trading | 15:05–15:30 (For SSE STAR Market only) |

15:05–15:30 (For SZSE CHINEXT Market only) |

For stocks listed on SZSE CHINEXT Market, they are not allowed to trade through SZ-HK China Connect. |

09:20-09:25, 14:57-15:00: SSE/ SZSE will not accept order cancellation

09:10-09:15; 09:25-09:30; 12:55-13:00: Orders and order cancellations can be accepted by SEHK but will not be processed by SSE until SSE’s market open

Orders that are not executed during the opening call auction session will automatically enter the continuous auction session

Any buy or sell orders not executed during the continuous auction session will automatically enter the closing call auction session.

Southbound trading follows SEHK’s trading hours

Shenzhen-Hong Kong Stock Connect / Shanghai-Hong Kong Stock Connect operate only on trading days for both Shenzhen / Shanghai and Hong Kong markets. If the fund settlement day is not a trading day in Hong Kong, Northbound Trading is closed on the previous trading day.

If a Northbound trading day is a half trading day in the Hong Kong market, Northbound trading will continue until respective Connect Market is closed. Please refer to the HKEX website for the Northbound trading calendar for Shanghai Connect Northbound trading and Shenzhen Connect Northbound trading.

The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

| Mainland | Hong Kong | Open for Northbound Trading? | ||

| Day-1 | Business Day | Business Day | Yes | |

| Day-2 | Business Day | Business Day | No | HK market closes on money settlement day |

| Day-3 | Business Day | Public Holiday | No | HK market closes on trading day |

| Day-4 | Public Holiday | Business Day | No | Mainland market closes |

Please refer to the HKEX website for the Northbound trading calendar for Shanghai Connect Northbound trading and Shenzhen Connect Northbound trading.

3.4. What is the contingency arrangement under severe weather conditions?

| Scenarios | Northbound Trading of SSE/SZSE Securities | Hong Kong Market today |

| T8 / Black rainstorm issued before HK market opens (i.e. 09:00 a.m.) | Not Open | Not Open |

| T8 issued between 09:00 a.m. and 09:15 a.m. | Not Open | Trading terminates after Pre-opening Session |

| T8 issued after SSE/SZSE market opens (i.e. 09:15 a.m.) | Trading will continue for 15 minutes after T8 issuance, thereafter, only order cancellation is allowed till SSE/SZSE market close | Trading terminated in 15 minutes |

| Black rainstorm issued after HK market opens (i.e. 09:00 a.m.) | Trading continues as normal | Trading continues as normal |

| T8 / Black rainstorm discontinued at or before 12:00 noon | Trading resumes after 2 hours | Trading resumes after 2 hours |

| T8 / Black rainstorm discontinued after 12:00 noon | Not Open | Not Open |

| SSE/SZSE is suspended due to bad weather | Not Open | Trading continues as normal |

For details of the existing typhoon/rainstorm procedure for the Hong Kong market, please refer to the HKEX website

3.5. Can investors trade through their existing broker(s) in Hong Kong?

Hong Kong and overseas investors can trade SSE/SZSE Securities through any EPs, so long as the chosen EP is eligible to participate in Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect.

3.6. Do investors need to open any additional account with any party to trade SSE/SZSE Securities under Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect?

Investors should discuss with their brokers on the detailed arrangements of participating in Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect, including whether they need to open a separate account for trading SSE/SZSE Securities, in addition to the one for trading Hong Kong shares.

4.1. What are the clearing risk management measures in place under Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect?

ChinaClear will generally apply its existing risk management measures on HKSCC’s unsettled positions on SSE/SZSE Securities. HKSCC will in turn adapt ChinaClear’s risk management measures and impose them on CPs and trading SSE/SZSE Securities. These risk management measures are largely similar to those imposed by ChinaClear on its other clearing participants.

To avoid risk spill-over across the border, ChinaClear will not contribute to the HKSCC Guarantee Fund and ChinaClear will not be required to share and default loss of CPs. CPs’ Guarantee Fund contributions will not be utilized to offset close-out loss in ChinaClear default.

Should the remote event of ChinaClear default occur and ChinaClear be declared as a defaulter. HKSCC’s liabilities in Northbound trades under its market contracts with CPs will be limited to assisting CPs in pursuing their claims against ChinaClear. HKSCC will in turn distribute the stocks or monies recovered to CPs on a pro-rata basis.

4.2. Is the RMB Equity Trading Support Facility (TSF) available for obtaining RMB funding to trade SSE-listed shares / SZSE-listed shares under Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect?

TSF, which serves as a back-up facility to enable investors to buy RMB-denominated shares on SEHK with HKD, will not cover SSE/SZSE Securities initially. Hence, investors will need to use their RMB to trade and settle SSE/SZSE Securities.

4.3. How would SSE/SZSE Securities under Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect be custodised for Hong Kong and overseas investors? Can investors hold SSE/SZSE Securities acquired through Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect in physical form?

Since SSE/SZSE Securities are issued in scripless form, physical deposits and withdrawals of SSE/SZSE Securities into/from the CCASS Depository will not be available.

As explained above, Hong Kong and overseas investors can only hold SSE/SZSE Securities through their brokers/custodians. Their ownership of such is reflected in their brokers/custodians’ own records such as client statements.

5.1. How much does it cost to trade and settle SSE/SZSE Securities under Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect?

Under Shanghai and Shenzhen Stock Connect, Hong Kong and overseas investors will be subject to the following fees and levies imposed by SSE, SZSE, ChinaClear, HKSCC or the relevant Mainland authority when they trade and settle SSE Securities and SZSE securities:

Fees and taxes applicable to a Northbound trade:

| Items* | Rate | Charged by |

| Handling Fee | 0.00487% of the consideration of a transaction per side | SSE/SZSE |

| Securities Management Fee | 0.002% of the consideration of a transaction per side | CSRC |

| Transfer Fee | 0.002% of the consideration of a transaction per side | ChinaClear |

| 0.002% of the consideration of a transaction per side | HKSCC | |

| Stamp Duty | 0.1% of the consideration of a transaction on the seller | SAT |

* Please refer to the latest announcement of the related Stock Exchange website for details.

Fees and taxes to be confirmed with the relevant regulators/authorities:

| Items | Description | Charged by |

| New CCASS Fee | A new fee for providing depository and nominee services to CPs for SSE/SZSE Securities (Subject to SFC’s approval) | HKSCC |

| Dividend Tax | Applicable to cash dividend and bonus issue (Subject to clarification with SAT) | SAT |

| Capital Gain Tax | Applicable to share disposal (Subject to clarification with SAT) | SAT |

Dividend tax will be withheld by issuer and ChinaClear upon dividend payment. The New CCASS Fee, if implemented, will be collected in HKD on a monthly basis.

Note:

Shanghai-Hong Kong Stock Connect/ Shenzhen– Hong Kong Stock Connect information will be updated from time to time as the implementation progress; the summary is an abstract of the information provided by HKEx and it may not reflect the latest progress. For details, please refer to HKEx website. This summary is last updated on 1st Mar, 2021.

Source: HKEX

| Information provided by: etnet | ||

| Terms and Conditions | ||

| Risk Disclosure: |

| The prices of securities may fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities. The information is for reference only, it does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment product or service. Customers should not make any investment decisions based on this information alone. |

| Disclaimer: |

| This information is provided by ET Net Limited ("ET Net") and/or its third party information providers (the "Sources") and is strictly for reference only. It is not intended to provide any financial or professional advice and any person should not rely upon the same as such. You should obtain relevant and specific professional advice before making any investment decision. Before making an investment decision, you should consider, with the assistance of your professional securities adviser, whether the information is appropriate in light of your particular investment needs, objectives and financial circumstances. ET Net and the Sources endeavor to ensure the accuracy and reliability of the information provided. Notwithstanding the aforesaid, ET Net, the Sources, Nanyang Commercial Bank Limited do not guarantee or make any representation, warranty or undertaking as to the accuracy, reliability, completeness or timeliness of this information, and accept no responsibility or liability whatsoever (whether in tort or contract or otherwise) for any loss or damage howsoever arising from or in reliance upon the whole or any part of such information. |